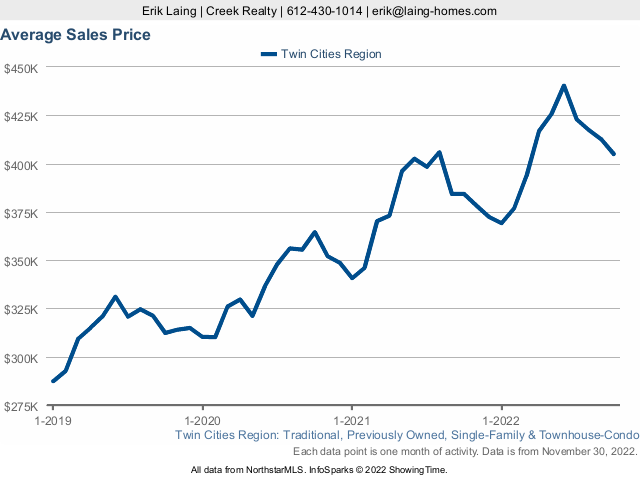

As I write this entry, winter seems to finally have descended on our part of Minnesota. Along with our economy, the real estate market in general has been a topic on many people’s minds. There’s a lot to unpack here as it relates to your home’s current value as well as where it will go in the coming year. Keep in mind that everything that matters is hyper-local when it comes down to it so your own situation may differ some from the general outlook. The wide angle view of our area shows the average home price sits at $404,935 and is up 5.4% in 2022 (for our purposes, “Average” means a single family home/townhome that is previously-owned and sells in a typical transaction and not foreclosure).

But what does 2023 look like? That’s a relevant question for everyone (and not just those people looking to buy or sell a home in the coming year) – I hope to answer that and more in my annual look back at the current year as well as what’s likely to come.

The First Part of 2022

Locally, we started 2022 with the average home priced at 385K, and our supply at 1 month (a “balanced” market for buyers and sellers is thought of as 6 months supply of homes on the market). Keep in mind, we entered the pandemic period of home buying with a 2-month supply, so inventory was historically low to begin with. What happened between January and June sent buyers’ and sellers’ heads spinning – the average interest rate on a 30 year fixed-rate mortgage leaped from 3.2% in January to it’s current position around 6.7%. It reached nearly 7.5% at one point, creating significant financial hurdles for many buyers. To put that in perspective, a buyer purchasing the average house of $385,000 at that time could expect a monthly payment in the neighborhood of $1,477 (this presumes a 20% down, conventional mortgage, property taxes of $3850 annually, and homeowner’s insurance of just over $1000 per year. If you bought the SAME PRICE house in November 2022 the same monthly payment would be $2,100, costing an additional $600 a month.

Keep in mind, buyers who could afford to absorb some cost caused home prices to rice into June of this year, so there are certainly people currently paying $2700 each month for the average house. That means buyers who couldn’t bring a 20% down-payment to the purchase could be paying more, or could find themselves priced out of the market. It is a given that buyers would pull back.

The second half of the year

Our clients who were active during the early summer had to consider how the monthly payment affected their financial position. Some chose to lower their price range while others expanded their search to include other, more affordable, areas to focus on. Almost immediately, newly listed homes spent more time on market. Between June and August, the average days on market for a home went from 19-24. Since most home sales lag by 30-45 days from an accepted offer, June sales could reflect home sales agreed to in May and late April.

It wasn’t just previously-owned home sales that were hampered; new construction deals fell apart locally and nationally. With their long contract times of 6-10 months between agreement and move-in/closing date, some buyers just couldn’t afford the monthy payment increase referenced above and had to cancel. I personally am familiar with three such cases of this, and all of those parties forfeited a good chunk of earnest money to make the cancellation. This was not an easy decision for buyers as it could potentially cost them thousands of dollars to cancel and the are back on the market looking.

Since June, the average sales price has dropped about 8% from a high of $440,000 locally, but this hasn’t erased all the gains homeowners likely saw; our average home cost $310,000 at the beginning of 2020. In practice, we typically see a seasonal slow down of sales reflected in November, but this year it came earlier, with a steep reduction in sales arriving in October. One national analyst I follow points out that purchase mortgage applications are down 41% year over year – this is certainly understandable.

On a year-over-year basis, mortgage purchase applications are down 41.4%.

Refi applications are down 85.9% on a YoY basis. pic.twitter.com/8bvJPJO8oA

— Lance Lambert (@NewsLambert) November 30, 2022

What’s on the horizon?

While I am no economist, I pay attention when experts speak on the topic so I have been spending the better part of this year reading and listening to what is going on and applying that to how things look in real time for our market. There’s some apprehension on the part of buyers and sellers as to what 2023 will bring, and while there’s no clear consensus on what interest rates will do, I don’t see a sharp decline likely in 2023. For reference, the National Association of Realtors (NAR) predicts interest rates to stay near 7% through 2023 while the Mortgage Bankers Association predicts rates into the mid-5s in the coming year. Fannie Mae is quoted as predicting rates to be between 6.2 and 6.6% though, so it is safe to say that rates aren’t returning to what many think of as normal any time soon.

For 2023, less homes sold is likely to be the prevailing headline. Either stability in the interest rates, or a decline could improve this, though it’s tough to predict exactly how that plays out. Lawrence Yun, Chief Economist for the NAR sees a 1% decline in home prices nationally as likely in 2023. I’m hesitant to rely on national numbers though, as the West Coast seems to be applying pressure on those numbers more than our local situation suggests. There generally seems to be agreement (highlighted passages here and here) by economists that 2024 will be a rebound year with home sales jumping 10% and the average price increasing by 5%.

My personal take

The need for housing is constant and I have found the buyers are more often concerned with SAVING money more than MAKING money when it comes to their homes. People are more deterred by the home price of the buying side of their transaction than with the selling side. That doesn’t mean no one cares about the profit, but it is likely more difficult to swallow paying more each month for your next house than it does the one time benefit of selling. If you’re looking to buy in 2023, it can be done as long as you have a clear picture of what it will cost as it relates to your household finances. Working with a QUALITY lender is key to this – enlist their help now (if you don’t know of one, I have several for each client’s unique needs that I can recommend) to navigate this process.

I see the next year as being tougher for first time buyers, especially those without a lot of savings for down payment. Move-up buyers and anyone down-sizing are still in a very good position. Remember that interest rates are temporary and a home can be refinanced. Over the long haul, housing does not get cheaper though, so renting or hesitating to get into homeownership if it is a desire of yours do not serve you.

We sit on the edge of a major demographic shift – by 2024, the youngest baby boomers will be aged 60, and the oldest 78 according to the US Bureau of Labor Statistics. The majority of these people will be retired from the workforce by then. This is a large group of people that represent a wide range of homes and price points owned, and in my experience this generation is already considering what changes to their housing situation are necessary for their retirement years.

The coming year will likely bring some strategies we haven’t seen in a while as our market likely turns to a more balanced one – if you are considering selling, you may want to consider whether your mortgage is assumable for a new buyer (not all are). Likewise this market will favor buyers who have their finances in order so we can write a compelling offer for sellers that meets your needs as a buyer!